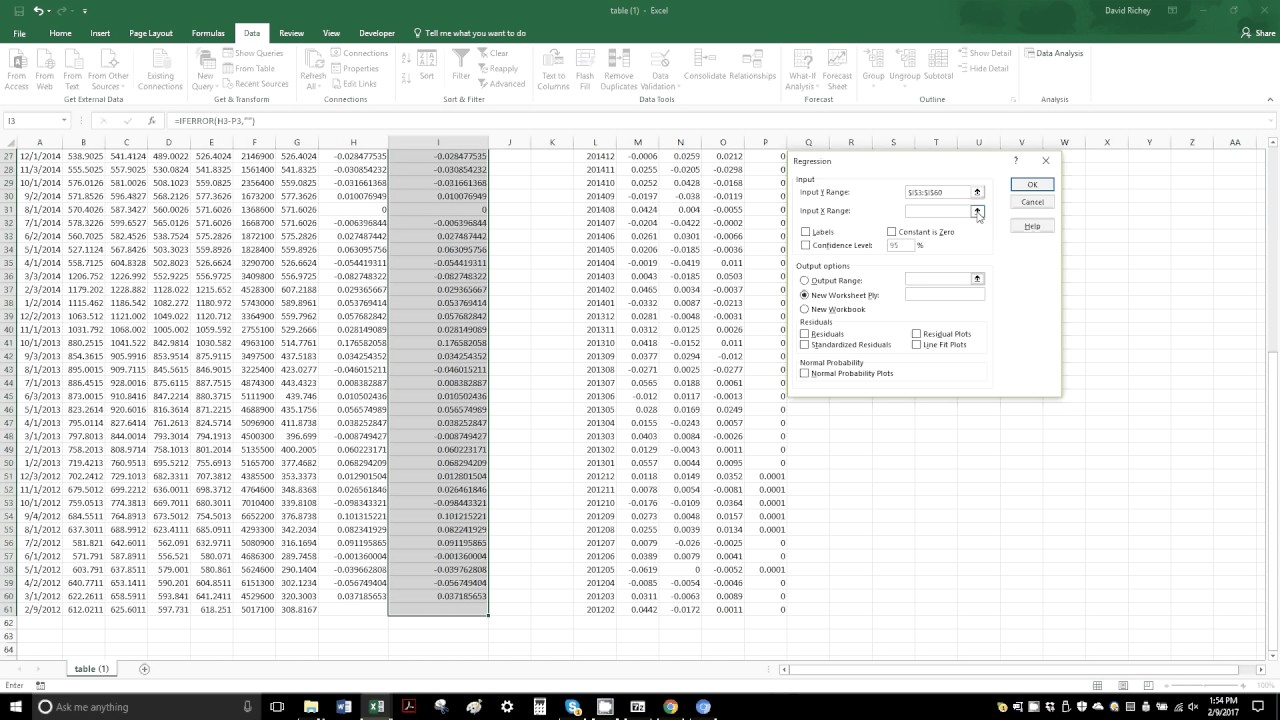

Linear Regression with four independent variables and one dependent (Carhart four-factor mode) : r/excel

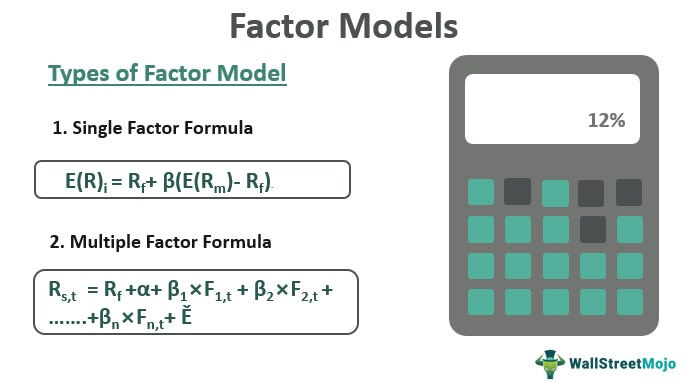

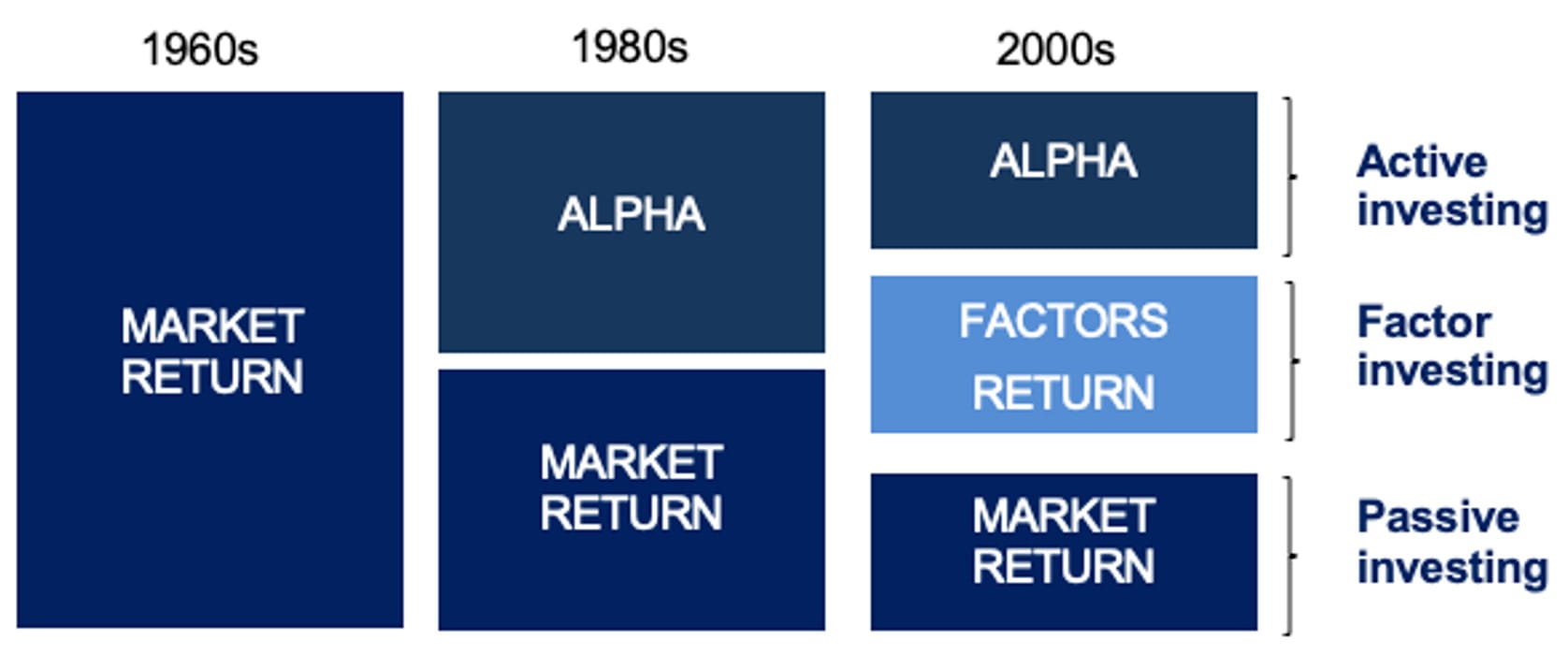

PDF) Testing Carhart Four-Factor Model and Size, Value, Momentum Effects on the Cryptocurrency Market

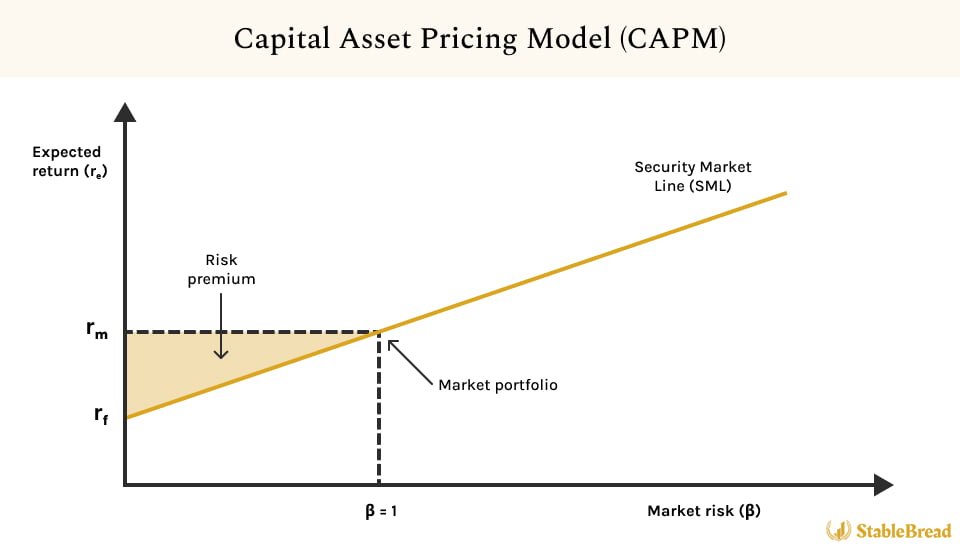

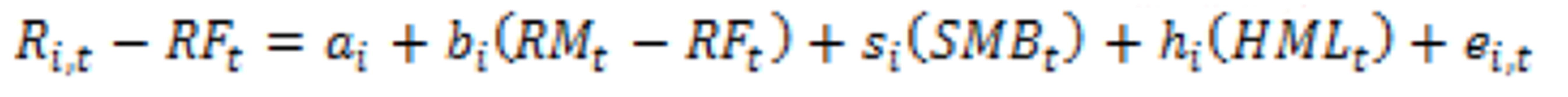

SciELO - Brasil - The Earnings/Price Risk Factor in Capital Asset Pricing Models The Earnings/Price Risk Factor in Capital Asset Pricing Models

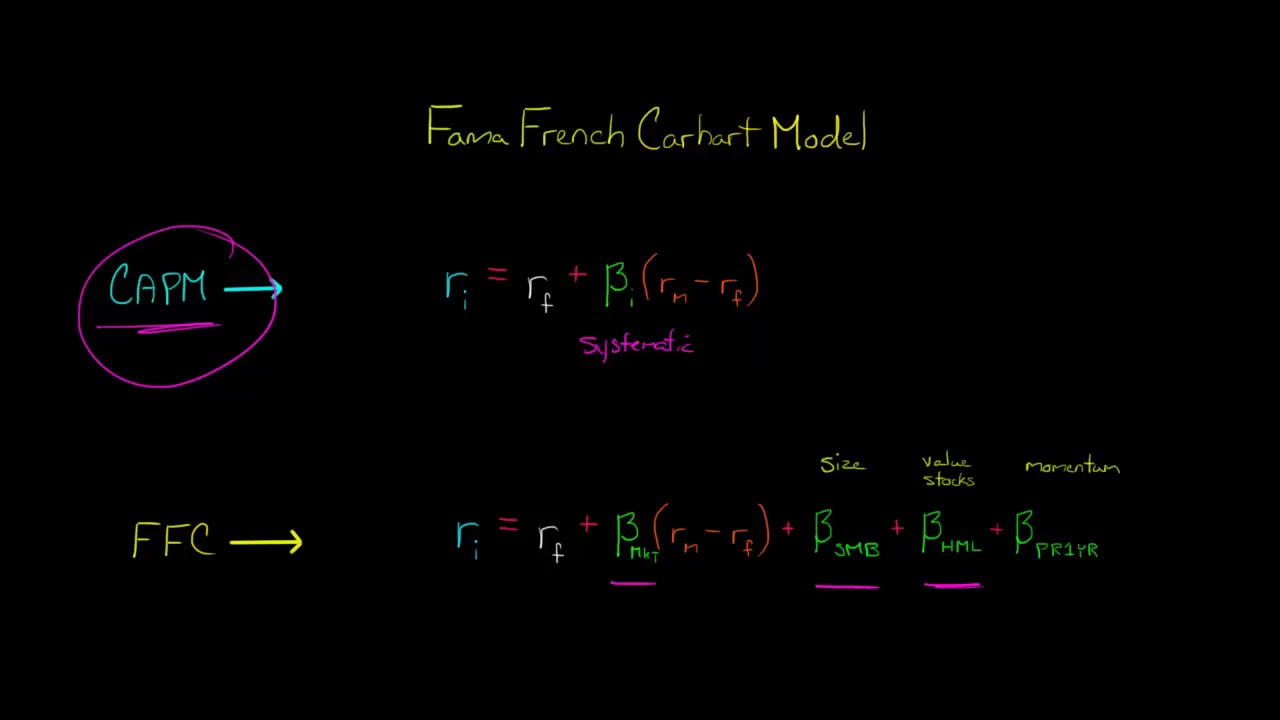

Does the Fama-French three-factor model and Carhart four-factor model explain portfolio returns better than CAPM? : - A study performed on the Swedish stock market. | Semantic Scholar